ENFORCE FINANCIAL CYBERSECURITY

The 5th Edition of the Financial Security Conclave, organized by the Data Security Council of India (DSCI), was held at the JW Marriott in Mumbai, providing an in-depth analysis of the current cybersecurity environment for the BFSI sector. The Financial Services Conclave (FinSec) is a cybersecurity-focused event in the BFSI sector that seeks to explore the technological developments that are leading to digitization, while also addressing issues related to security, privacy and emerging opportunities.

The FinSec Conclave was a two-day event that brought together a broad cross-section of industry professionals, global thought-leaders, cybersecurity professionals, policy experts, and India’s cutting-edge technology innovators, their key stakeholders from financial services organizations covering sectors such as Banking, Mutual Funds, Securities, Insurance & Pension, all shared their insights on the latest trends and strategies in financial security.

The event featured more than thirty sessions and seventy speakers, including industry-focused workshops, keynote speeches, plenary sessions, and special sessions, as well as visionary meetups and fireside chats, as well as parallel tracks and focused group meetings. The event concluded with a townhall session with Cert-In, an Indian Computer Emergency Response Team. Additionally, the Conclave marked the commencement of DSCI’s sectoral privacy initiative, the banking guide.

The summit discussed a variety of provocative topics, with a focus on essential topics such as “Fin cloud,” which examined the security of cloud computing in the financial sector. Discussions also focused on the cyber resilience of financial infrastructures, the relationship between cyber insurance and ESG principles, ransomware readiness and response, as well as the global financial crime and fraud environment.

Other noteworthy topics included application security in the cloud, decentralized finance, future of digital identity authentication and authorization, mobile banking security, data-driven BFSI strategies, and cyber vision of industry pioneers.

The conclave was attended by more than 35 partners, which included Indian cybersecurity startups and cutting-edge companies, to showcase their innovative technologies through collaborative efforts.

The 10th annual Innovation Box, which coincided with the Summit, has been a driving force in the development of innovative BFSI products, serving as a showcase for startups to showcase their cybersecurity innovations. The Innovation Box has gained global recognition, enabling industry leaders to recognize and recognize the most innovative innovation of the year, and the Innovation Box is looking to broaden its reach by expanding its scope to additional sectors, thereby promoting a culture for innovation across a variety of industries.

Vinayak Godse, the Chief Executive Officer of DSCI, in his inaugral speech, highlighted the importance of cybersecurity in the current climate, while also recognizing the immense potential that lies ahead and the difficult tasks that must be tackled together. He highlighted the importance of digitizing payments and the financial sector’s aggressive plans to digitize, as well as the rapid adoption of new technologies. He predicted that the future of financial services would be revolutionary, flexible, and creative, with an ever-expanding digital presence and finance being integrated into every aspect of the digital world. However, he warned that addressing the intricate issues of security, privacy and fraud would require a combination of effort and ongoing learning.

Mr. Godse stated that the objective of the FinSec Conclave 2023 is to foster knowledge sharing, explore the current financial security landscape and its challenges, and work together to create a future of financial security. The event brings together key players in the BFSI, Fintech, policy, regulatory, security, technology, research, and start-up sectors to create a dynamic platform for discussion on the challenges, opportunities, and innovations that shape the financial sector.

Vinayak Godse, Chief Executive Officer, DSCI in his address said, “Cybersecurity has reached an inflection point, where challenges are daunting but opportunities, they throw are immense. With great achievement in digitizing payments, and aggressive digitization plans of the financial sector, and with rapid adoption of emerging technology we would witness, the future of finance would be more revolutionary, scalable, and innovative. With an expanding digital footprint, unbundling of transaction processing, rising complexities of underlying systems, and finance becoming embedded in every digital aspect, it will not be easy to manage challenges of security, privacy, and fraud with collective learning and effort. FinSec Conclave 2023 is envisioned to promote this learning, examine the current paradigm and challenges associated with it, and explore the future of financial security together. It brings BFSI industry, the Fintech ecosystem, policy makers and regulators, security leaders, security technology players, researchers, and start-ups together for a dialogue on challenges, possibilities, and innovation shaping the financial sector.”

FINSEC 2023 focused heavily on Privacy and Data Protection, and sought to identify best practices in this area that could make a significant contribution to the Privacy journey of financial services organizations. As countries continue to make significant progress in relation to the comprehensive Privacy legislation, the focus on Preparedness and Implementation is expected to be a key area of focus for financial services organisations. The Privacy sectoral nuances will be further discussed at the Conclave.

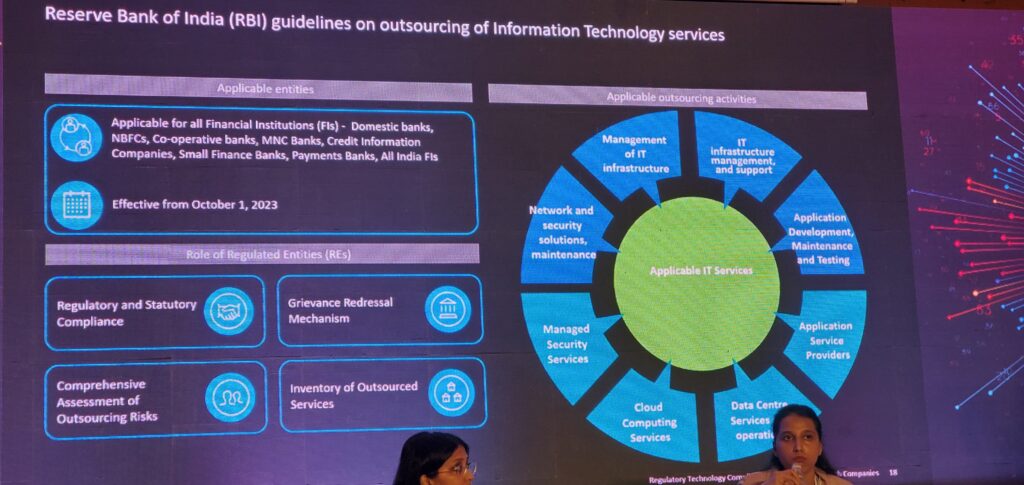

Ashish Chalke, System Engineer, and Munjal Kamdar, Partner in Risk Advisory at Deloitte organized a workshop on RegTech compliance for Financial Institutions in India – Managing your regulatory compliance risk.

RegTech solutions are primarily designed to reduce regulatory compliance costs, enhance reporting accuracy, and enhance operational stability and efficiency, while also allowing for the development of capabilities to support growth.

Fintech firms may experience operational challenges in the short-term as a result of regulatory changes. However, these changes will necessitate more creative solutions to address issues related to risk management and underwriting, as well as other segments, which will ultimately benefit consumers, companies, and regulators.

At the inaugural plenary session of the first day of the Finsec2023 conference, “Vision 2025: digital payment security and privacy agenda for contactless, interoperable, contextual, resilient, and global vision” moderated by 1Kosmos Advisory Board Member Nandkumar SARAVADE, the panelists included AI Garage Mastercard Senior Vice President Nitendra Rajput and Chief Operating Officer of the National Payments Corporation of India (NPCI) Praveen Rai and Director-General, Directorate-General for Security and Information (DSCI) Vinayak Ghandly. The Reserve Bank of India (RBI) presented its payments vision for the acceleration of India’s economic growth, highlighted by Praveen Rai’s emphasis on the core principles of safety, security and interoperability, while Ghandly highlighted the democratization and decentralisation of the digital payment ecosystem.

RBI’s purpose of the Payments Vision 2025 is presented across the five anchor goalposts of Integrity, Inclusion, Innovation, Institutionalisation, and Internationalisation. Resilience to operational and security concerns would continue to be at the heart to withstand and recover from the evolving threat landscape. The integrity of payment systems shall be non-negotiable for buttressing customer confidence.

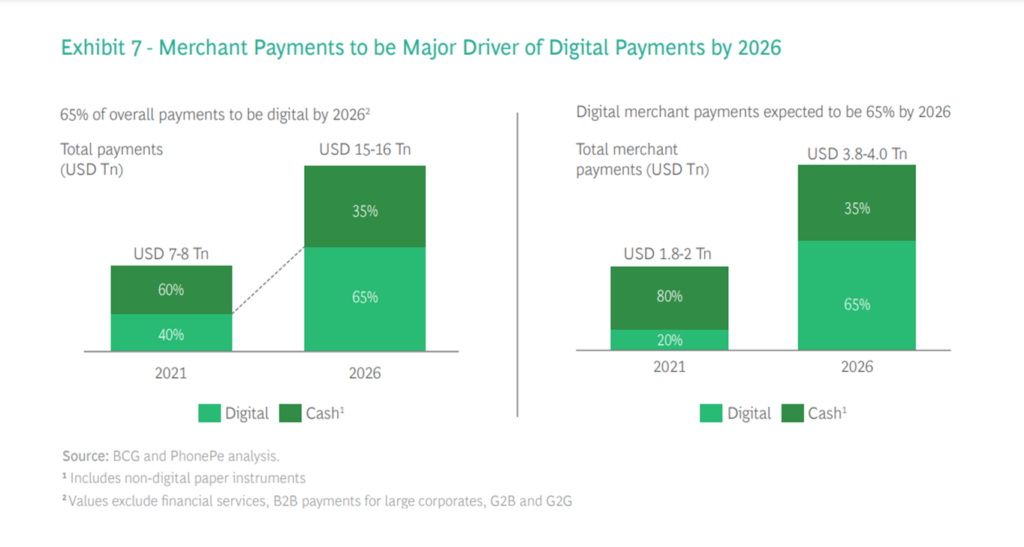

India’s digital payments are expected to reach a whopping $10 billion by 2026, compared to just $3 billion currently, according to a study by PhonePe and BCG.

Mr. Sandeep Variyam from PaloAltoNtwks gave a keynote presentation on simplifying the importance of security consolidation & why it should be a top priority for business leaders.

Security consolidation is all about getting rid of all the different security processes and tech used by your organization. It’s a way to make sure all the attack surfaces in your security environment are protected using the same log technology, threat detection and threat intelligence. Consolidated security architecture is designed to help you get the most out of your multi-tech security networks by making them more efficient, giving you more control over your network and giving you a better return on investment.

Cyber attacks on enterprises are growing in frequency and severity. Global cyber attacks increased by 38% in 2022, and business leaders are feeling the impact, according to our What’s Next in Cyber 2022 report on 1,300 C-suite leaders. The latest attacks target vulnerabilities in different networks, clouds and endpoints. They use tools like AI to bypass traditional cyber defenses used by organizations. Cybersecurity consolidation combines multiple, siloed security functions into security platforms that manage your business risks by protecting your entire IT environment.

The Summit provided an excellent overview of the current Cyber Security environment of the country’s banking, financial services and insurance (BFSI) sector, highlighting the digital transformation that is driving security and privacy concerns and opportunities.

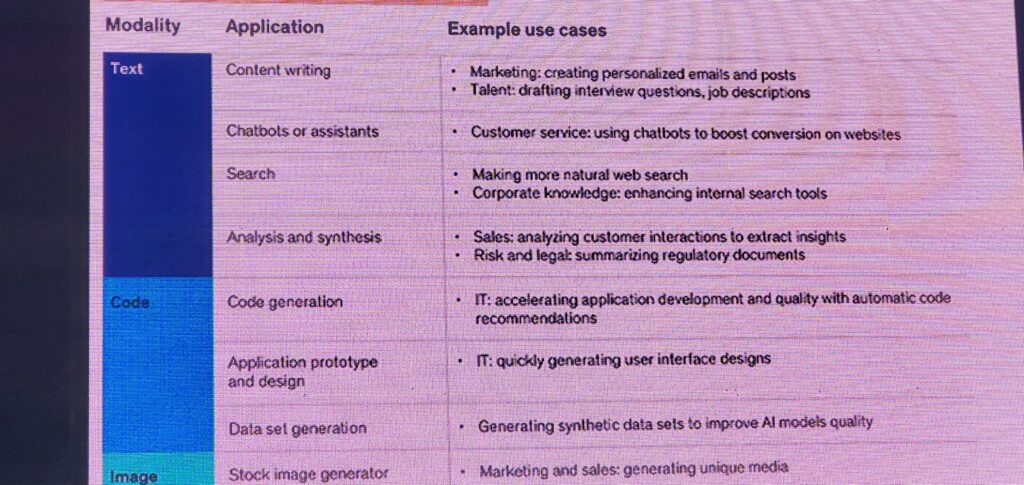

Atul Kumar, Lead – Government Initiatives – DSCI presented on Examining generative ai phenomenon from security standpoint – gauging the organizational response. Generative AI has emerged as one of the most significant new technologies of the present day, however, its development also faces a range of uncertainties and difficulties. Business leaders must take steps to enhance corporate governance and oversight, while also raising staff awareness and comprehension of the technology. Generative AI is a branch of Artificial Intelligence that is capable of autonomously generating new content. However, it has raised concerns regarding the potential adverse impacts of its development, including the potential danger to humans. As a result, it is becoming increasingly important to regulate the development of Generative AI.

As a result of its development, Generative AI models are now trained on incredibly large collections of text and code, as well as images and other data. These models are now capable of producing, on request, comprehensive and convincing stories, news reports, poetry, lyrics, images, and programs. Generative AI is a flexible technology that operates within its own parameters, and is often sufficiently intelligent to extrapolate from these parameters when necessary.

Co-founder of Cloudsek, Rahul Sasi, gave a talk about how important it is to make sure your digital supply chain is secure and that you’re protected from any kind of attack. He talked about how important it was to make sure your supply chain is secure.

Cyber-attacks trends are on the rise at an alarming rate due to the proliferation of advanced tools and methods for launching targeted attacks. A robust threat intelligence feed is essential for any industry to remain vigilant and defend against advanced attacks. Threat intelligence plays a critical role in staying informed and making proactive security decisions.

“Security has come to a point where its implications are being seriously discussed. This is why we have organized this conference to discuss and create a meaningful dialogue about the advancements made in the cybersecurity field.

The objective is to acknowledge and learn from the ongoing work being carried out in different sectors. Given the diverse range of security disciplines that have emerged over the years, it is essential to have a collective understanding.” Mr. Vinayak Godse at #FINSEC2023.

For the startup ecosystem, Mr. Vinayak Godse at FINSEC2023 said: “There are so many innovations happening around us. We have so many startups who are bringing the solution to the table across critical technologies. The financial sector is going to become a big market to buy these security solutions.”

The 10th Annual Innovation Box, which co-hosted the Summit, has catalyzed the development of cutting-edge BFSI solutions, providing a platform for startups to present their cybersecurity innovations. This innovation box has achieved global recognition, allowing industry leaders to identify and celebrate the most innovative innovations of the year. The Innovation Box is planning to expand its scope by covering additional sectors, thereby fostering a culture of innovation across a broad range of industries.

The top six #startups were successful in advancing to the semi-final round of the DSCI – FINSEC Innovation Box, where they presented their top-of-the-line ideas, strategies, and innovations in front of a distinguished jury. Team NCoE and our cutting-edge startups are excited to engage with financial services stakeholders and demonstrate our cutting-edge FinSec solutions at the NCOE Pavilion.

10th Edition of DSCI #InnovationBox. The winners are-

1st Runner Up – Fourcore

2nd Runner Up – Secure Blink

Winners – Protecttai and Secops Solution

Data Security Council of India (DSCI) is a premier industry body on data protection in India, setup by nasscom®, committed to making the cyberspace safe, secure, and trusted by establishing best practices, standards and initiatives in cyber security and privacy. DSCI brings together governments and their agencies, industry sectors including IT-BPM, BFSI, Telecom, industry associations, data protection authorities and think tanks for public advocacy, thought leadership, capacity building and outreach initiatives.